News

Regulations for Foreigners Working in Vietnam

Foreigners working in Vietnam must comply with legal regulations to ensure legality and workplace safety. Below are the key requirements for individuals and recruiting companies:

1. Work Permit

According to Vietnamese Labor Law, foreigners without a work permit cannot work in Vietnam unless exempt. Exemptions require a Certificate of Work Permit Exemption.

- Who needs a permit: Experts, managers, executives, or technical workers.

- Some cases are exempt from work permits, including:

+ Working under 30 days at a time and no more than 90 days annually.

+ Internal transfers in enterprises in 11 WTO-committed service sectors.

+ Foreigners married to Vietnamese citizens residing in Vietnam.

- Validity: A work permit is valid for up to 2 years and can be renewed.

2. Work Permit Application Documents

Foreigners need to prepare the following documents:

- Valid passport: Original passport and valid visa as prescribed by law.

- Health check: issued within 6 months by legal medical institutions.

- Qualifications and certifications: University degree, teaching certificate (TESOL, TEFL, CELTA for English teachers), or other documents proving professional qualifications.

- Criminal record: valid for 6 months, issued locally or internationally.

- Labor contract: Between the foreigner and the employer in Vietnam.

3. Working Visa

Foreigners need to be granted a work visa symbolized as "LD"), required for the purpose of working in Vietnam.

- Typically issued after obtaining a work permit, sponsored by a company or organization.

- Validity: 1 to 2 years, depending on the work permit duration.

4. Temporary Residence Card (TRC)

- Can be applied for a TRC after obtaining a work permit.

- Valid for 1 to 2 years, aligned with the work permit duration. Simplifies legal residency and entry/exit procedures.

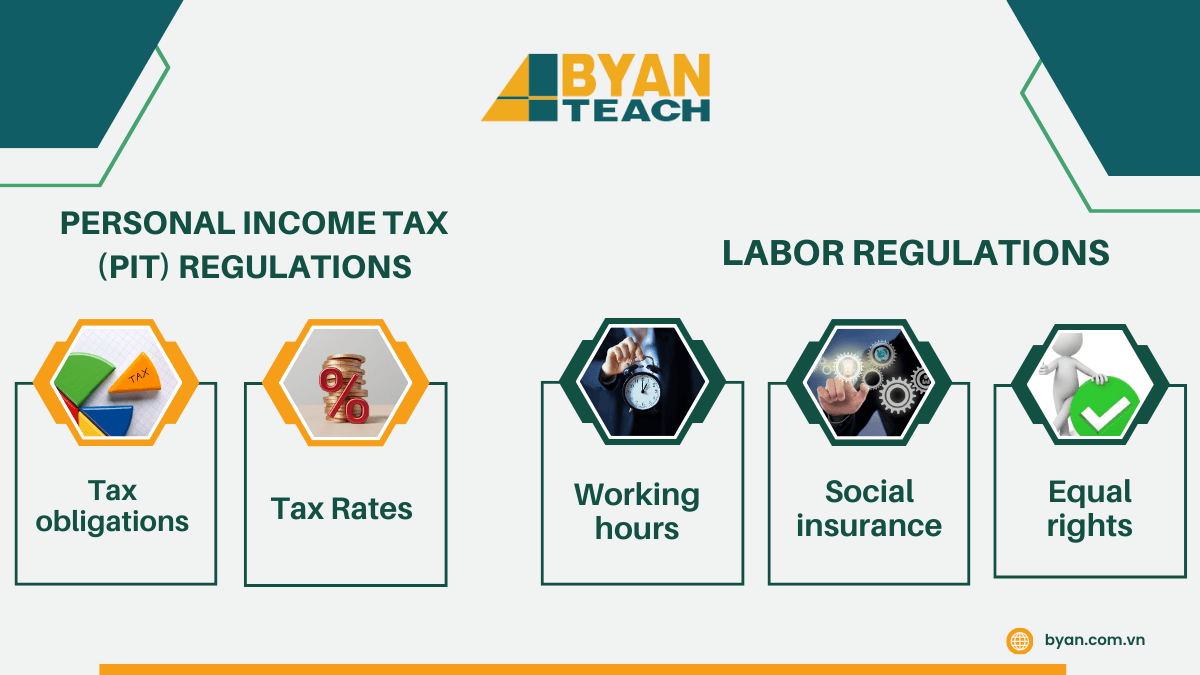

5. Personal Income Tax (PIT) Regulations

Foreign employees have to fulfill their personal income tax (PIT) obligations in Vietnam. Some points to note:

+ Tax obligations:

- Residents (183+ days in Vietnam annually): taxed on worldwide income.

- Non-residents (under 183 days): taxed only on Vietnam-sourced income.

+ Tax Rates:

- Salary income: Progressive from 5% to 35% (residents).

- Salary income: Flat 20% (non-residents).

6. Labor Regulations

Foreign employees and employers must comply with the Vietnamese Labor Law. Some main regulations:

- Working hours: Max 8 hours/day or 48 hours/week.

- Social insurance: Mandatory for foreign workers under labor contracts per the Social Insurance Law (effective Jan 1, 2022).

- Equal rights: Foreign employees are entitled to leave, holidays, and other benefits akin to Vietnamese employees.

7. Cultural and Legal Respect

Foreign employees need to understand and comply with the laws, customs and culture in Vietnam, including:

- Work culture: Punctuality, respect for colleagues and professional communication.

- Local customs: Respect Vietnamese holidays, customs and practices.

- Law compliance: Do not participate in activities that violate the law or disrupt public order. Adhere to local laws, customs, and workplace ethics.

8. Choosing a Reliable Consultant

Partnering with professional service providers like Byan Teach simplifies compliance with work permit, visa, and residency requirements.

- Byan Teach is a leading unit specializing in providing foreign teachers, while fully supporting all necessary legal procedures.

Hiring foreigners in Vietnam necessitates thorough preparation to ensure legal compliance and operational efficiency For more convenience, businesses should seek professional service providers such as Byan Teach to receive the best support.